Looking

for an investor

We help innovate and grow businesses through

private equity investments.

„We approached Eterus Capital at the end of 2021, and we appreciate the fair and prompt communication throughout the transacti...

- Tomáš Červenka, CEO

on process, the equitable approach (especially in light of the radical change in the macroeconomic environment during the investment preparation) and a long-term view, which is important in a rapidly changing world. We start our business cooperation with good relations and in a spirit of partnership, which is not a matter of course in similar transactions”

„My experience with Eterus Capital has been above standard. Eterus has always been a fair partner for us and throughout our hi...

- Michal Štencl

story together since 2011, I cannot recall a single moment when we have been at odds, which is rather rare for other private funds. I have had the privilege of personally getting to know Michal Staroň and Boris Kostík, who are/were in various positions in our company on the Board of Directors/Supervisory Board, and we have always found in them the support we needed for further development of our company.”

„Eterus Capital acted as a responsible and fair partner during our negotiations, so I am glad that we have finally reached a c...

- Martin Winkler

onsensus and will be doing business together as partners. We were able to close the transaction very quickly, without unnecessary complications and "corporate" delays, tactics and in a very amicable spirit. I believe our future together will bring us many good things, despite some business challenges, and eventually, it will benefit Hopin, customers, employees and partners alike.”

„Eterus Capital, as one of the shareholders of Saneca Pharmaceuticals, has been a decent partner under all circumstances and t...

- Matúš Kutný

hrough its representatives in the company's bodies, it has regularly and actively participated in the company's business. Together, we strive to do our utmost for the stabilization and development of the company. Eterus also provides financial investments in the company's production base and technology.”

Is your company seeking capital?

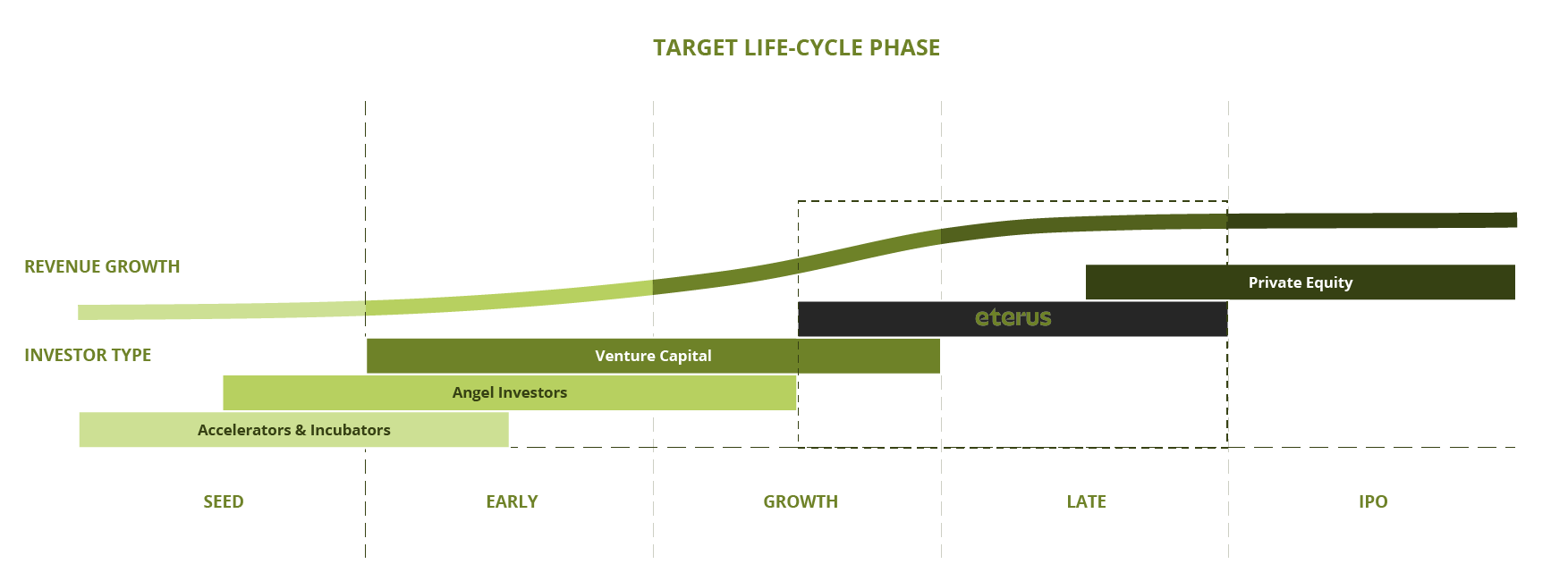

This is our investment strategy

- Well-established company

with appetite for expansion

We target companies with proven history, attractive potential for growth, and firm Slovak roots.

- Well-proven business concept

We look for ambitious partners seeking to build on established track record through domestic or international expansion.

- Capable management willing

to further develop the company

We craft our partnerships based on chemistry, aiming to endure both good and bad times.

- High-quality business plan

We endeavour realizing well-defined, scalable, and robust business plans.

What steps in the investment

process are to be expected?

- 01

- Business

plan

Prepare a high-quality business plan that captures the monetization of your product or service reflected in planned financial results for at least the next three years.

Come and present your business plan to us. We would love to meet you!

- 02

- In-depth

audit

After analyzing your business plan and agreeing on the framework terms of the investment, we will conduct appropriate and thorough due diligence on the company.

At this stage, we expect access to the company's management and an active discussion regarding any ongoing outstanding matters.

- 03

- Transaction

documentation

As part of the finalization of the transaction documentation (purchase agreement, shareholders' agreement), we will jointly specify the pre-agreed framework conditions of the investment and stipulate the rights of individual shareholders.

After successfully signing the transaction documentation, the financial settlement of the transaction (provision of capital) will proceed.

Let's build something

unique together

If you have any questions or wish to start implementing your expansion plans, please contact us.